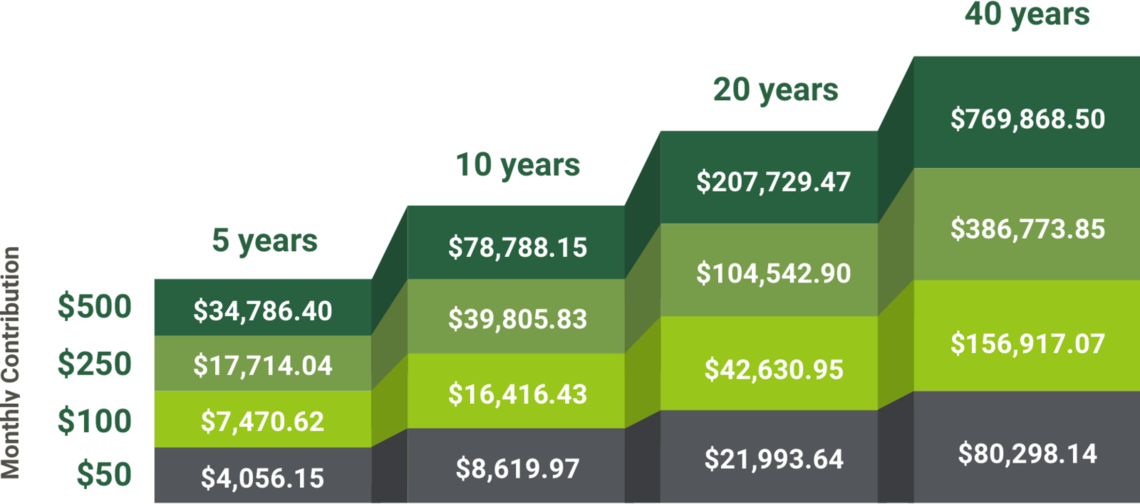

See how your contributions can add up

The standard contribution rate

The standard, default savings rate for an OregonSaves account is 5 percent of your gross pay (the amount you earn before taxes), and that amount is deducted from your paycheck after taxes have been taken out. To make your savings contributions, your employer can deduct from the amount available in your paycheck only after other payroll deductions required by law have been made.

Standard annual increase

Standard choices include a 1 percent annual increase in savings for your account, unless you choose otherwise. For example, if you start out at 5 percent, next year your savings rate will increase to 6 percent. Your savings rate will increase each year thereafter, until you reach 10 percent. You can elect not to have your savings rate increase in any given year.

Change your rate anytime

You can change your savings rate at any time to as little as 1 percent of your total pay, or as much as 100 percent, as long as it’s within IRS limits.

“It feels good to finally be building my retirement fund! Even though I am only saving a small portion right now I plan to up my contribution in the future.”

Sarah Minshall | Rogue Retreat

Medford, OR

Unsure of how much to save?

You’re in control of how much you save and can choose the level that is most comfortable for you. We offer resources and tools for those who may need a little extra support in their planning. You can also use our retirement savings calculator to experiment with different savings rates and see what fits your budget. Still need help? You may want to speak with a financial or tax advisor to help you assess your options.

Investments with an assumed 5% annual rate of return*

*This hypothetical example shows the potential of what an initial investment of $500 and a monthly contribution at a 5% projected annual rate of return could become over a period of time. Note this is just an example; your actual results may be more or less.

Contribution limits

Your OregonSaves account is a Roth IRA, so the total amount you save must be within the federal government’s Roth IRA contribution limits. In 2026, the contribution limits are $7,500 per year to a Roth IRA (and $8,600 per year if you are age 50 or older), as long as you earn at least $7,000 in wages.

The amount of money you can contribute to a Roth IRA depends on how much you earn and your Modified Adjusted Gross Income (MAGI), which is essentially what you earn at your job, plus any other income from investments and other sources. If you file taxes as a single person and your MAGI is under $153K in 2026, or if you are married and file jointly and your MAGI is under $242K, you’ll be able to contribute the maximum amount of $7,500 ($8,600 if you’re 50 or older). See this IRS publication for more information and an easy-to-follow worksheet for computing your MAGI.